Philippines Gaming Chief Optimistic: Believes Country Can Surpass Singapore in Gaming Industry

In the upcoming years, the head of PAGCOR, the Philippine Amusement and gambling Corporation, believes that the gambling sector in the nation can surpass that of Singapore.

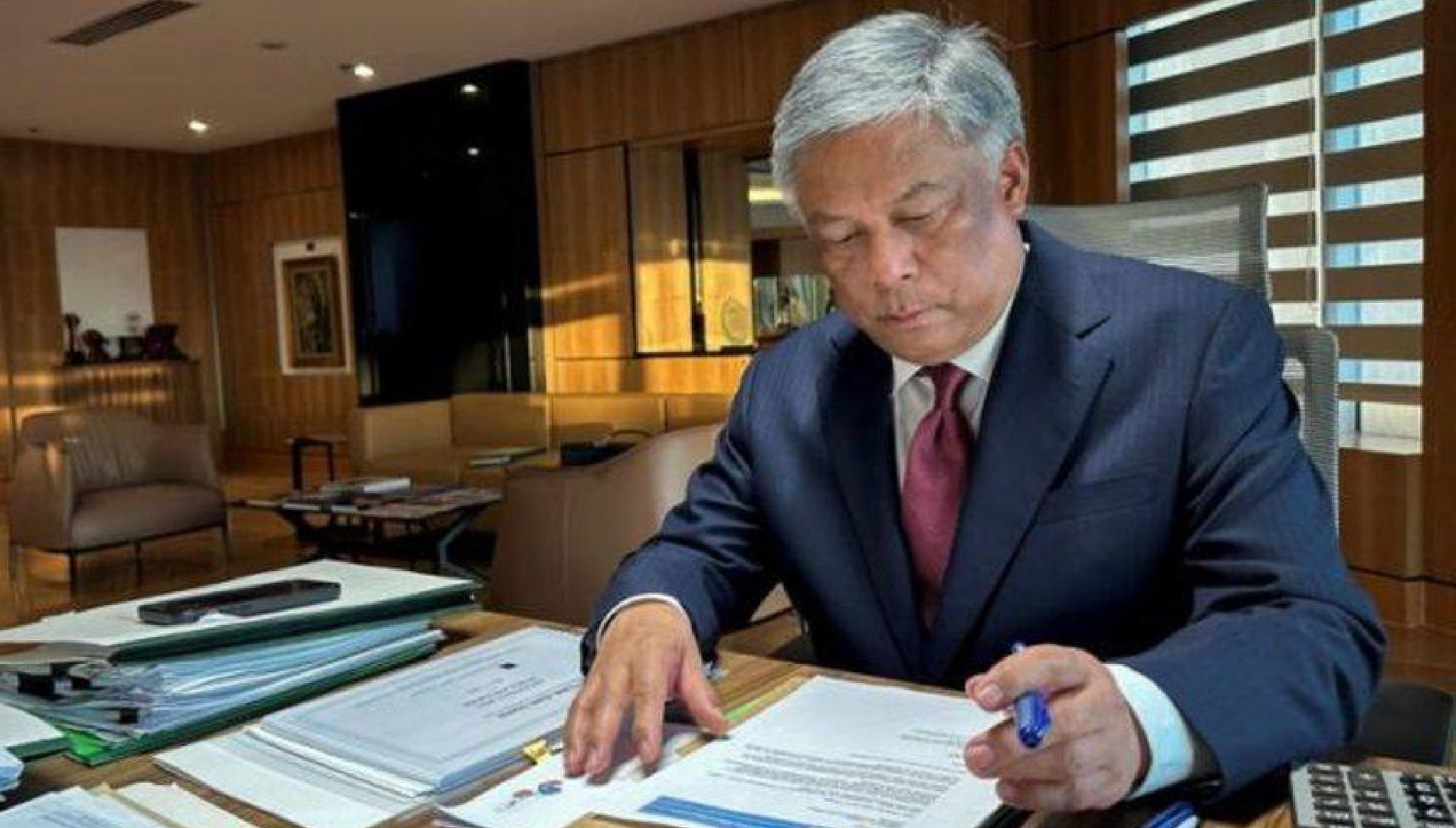

This week, PAGCOR Chair and CEO Alejandro Tengco expressed to reporters his belief that ultimately, the Philippines' casinos will surpass Singapore's duopoly in terms of yearly gross gaming revenue (GGR).

Marina Bay Sands and Resorts World Sentosa, two integrated resorts in Singapore, are managed and owned by Malaysian Genting and Las Vegas Sands, respectively. Tengco's prediction is something he believes will happen soon.

"If Singapore doesn’t expand, they will plateau. Don’t be surprised if next year we surpass them,” said the chief PAGCOR official.

Commercial casinos are subject to PAGCOR regulations both nationally and in specific economic zones such as Central Luzon's Clark Freeport Zone. Additionally, PAGCOR manages casinos under the Casino Filipino brand on behalf of the state.

Neck and neck already

This year, overall gaming income is expected to surpass last year's record of roughly $5.1 billion to a new high of 336 billion pesos (US$6.1 billion), according to PAGCOR.

$2.7 billion in gross gaming revenue was produced by Marina Bay Sands in the previous year. With a total win of approximately $5.1 billion, Resorts World earned almost $2.4 billion. Nevertheless, until February 13, 2023, Singapore was subject to COVID-19 restrictions; prior to that date, foreign visitors were only permitted for work-related and urgent purposes.

Billions of dollars are being invested by Sands and Genting to expand, modernize, and enhance their resorts. Each resort operator promised the Singaporean government those capital expenditures in 2019 in return for having their gaming licenses extended through 2030.

The opening of multiple new casinos in the upcoming years will be advantageous for the gaming sector in the Philippines.

Solaire North, a more than $1 billion development in Quezon City, serves as a focal point for the growth. Located in Manila's Entertainment City, Solaire North is the sibling resort to Solaire and will feature 550 hotel rooms in addition to a casino floor with 200 table games and 3,000 slot machines. Behind the casinos in Solaire is Bloomberry Resorts.

In addition to Solaire North, several casinos are planned or under consideration for Manila, the Clark Freeport, and popular vacation destinations like Cebu and Boracay.

Large financial wagers are being made by the Philippines' gaming stakeholders in the hopes that the nation would reclaim some of the VIP market share that Macau has lost. That is following the expulsion of junket groups by the Chinese enclave. Junkets is a service provider for affluent gamblers; they collaborate with casinos to invite high rollers into their exclusive gaming areas.

PAGCOR Redesign

In the upcoming years, PAGCOR will ultimately transition to a regulator-only role after more than ten years of deliberation.

By early 2026, Tengco intends to sell off its stake in the state-owned Casino Filipino company. Currently, 33 smaller "satellite" casinos and nine larger casinos are managed by PAGCOR.

The sale of Casino Filipino will only take place if PAGCOR's high demands are fulfilled. When the state agency first announced that it planned to sell the assets and gaming licenses in order to raise more than $1.4 billion.

Tengco announced this summer that the agency would seek $1 billion for the 41 casino locations, following the lack of interest shown by the gambling businesses.

As of right now, PAGCOR is the only gaming regulator in the world that runs casinos. For many years, the conflict of interest has been closely examined. Selling the Casino Filipino locations, according to Tengco, will allay ethical worries.